Important Information required before using Ftax Forms (3:10)

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

Important information required before using Ftax forms - Overview

To make a submission to HMRC you will need to have several important pieces of information to hand. It is very important that you keep a record of these and that you do not mix them up. This video will give you a brief explaination of these pieces of information and tell you where to find them.

Please see below for further information on:

- Your Government gateway ID and password

- Your UTR or Unique Taxpayer Reference

- If you are VAT registered, Your VAT registration number

- Your Ftax account Username and Password

![]()

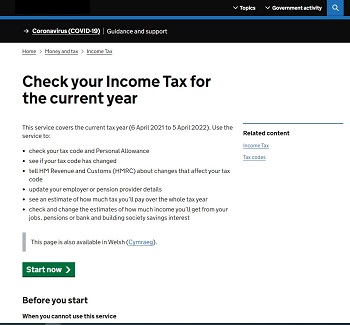

1. Your Government Gateway ID and Password

Your Government Gateway User ID consists of 12 numbers. To register go to www.gov.uk. You will need your name, date of birth, national insurance number and an email address.

Choose at least one service you want to use through the Gateway and create a password. You will see the following screens:

Once this department has verified that you are who you say you are, you will receive an activation code by email or post. Follow the instructions that come with this code within 28 days and your registration is complete.

![]()

2. Your UTR or Unique Taxpayer Reference

Your UTR or unique taxpayer reference that can be found in the top righthand corner of your SA100 tax form and once you have registered with HMRC, you can also find it on the personal information page of your tax account:

3. If you are VAT registered, Your VAT registration number

If registered for VAT, your VAT registration number is a 9 digit number. It can be foind on the top right of your VAT registration certificate. It should be clearly visible on all of your company's stationery.

4. Your Ftax account Username and Password

Please note that your username is now the same as your email address.

Please make a note of your username and password when you create your Ftax account.

4.1 Forgotten Username:

If you forget your username, click the link on the login page to request a reminder:

Please try all of your email addresses to contact us. If none of your email addresses allows you to access this service, send an email to support@ftax.co.uk with Forgotten Username as the subject.

4.2 Request a new Password:

If you have forgotten your password, click Forgotten Password on the login screen and a verification code which will allow you to rest your password will be emailed to you shortly:

4.3. Change your Username or Password yourself while logged in to your Ftax account

You can amend your username or password by logging in to to your account and going to My Account on the top right of your home page:

Scroll down past 'Billing Details' and you will see a section called 'Account Security' which will allow you to change both your Username and Password:

![]()

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk![]()